News:

Like generations before him, the only light Jurdar Thingya has at night in his one-room mud hut in Maharashtra comes from a small wood fire on the floor. A broken solar panel is all that the 35-year-old farmer has to remind him of the government’s promise to bring electricity to all of India’s villages.

Bhamana, population 1,500, is two hours’ walk from the nearest surfaced road, across a river that is impassable for months during the monsoon rains. Like other remote villages, it was powered by renewable energy as part of a drive to take electricity to every community in the state, according to Dinesh Saboo, projects director at Maharashtra State Electricity Distribution Co., the power retailer.

Maharashtra, home to the financial capital of Mumbai, declared itself fully electrified in 2012, relying on solar panels or small wind turbines to cover remote areas. India considers a village electrified if at least 10% of the households and public places such as schools have electricity.

But theft and damage have plunged 288 villages and 1,500 hamlets in Maharashtra back into darkness, according to Saboo. “Most of the equipment is either stolen or not working,” he said. “Now we have decided that a majority of these villages will be electrified in the conventional way.”

In India, political power and electrical power are closely linked. Prime Minister Narendra Modi’s ruling Bharatiya Janata Party, which also runs the state government of Maharashtra, was elected in 2014 partly on promises to bring electricity to rural voters. It has pledged to electrify all villages by May 2018 and supply power to every citizen by 2019.

“Rural electrification is one of the most critical issues on which the elections in India are being contested,” said Sandeep Shastri, a political commentator who teaches at Jain University in Bengaluru. “People will weigh the promises of the governments—both federal and state—on the basis of implementation. Their electoral gains will be determined by the credibility of their promises.”

Shastri said rural electrification contributed to the landslide win last week of Modi’s party in Uttar Pradesh, one of India’s least-developed states, where voters compared the federal government’s efforts with the lack of progress from the incumbent state government.

Power surge

There are a lot of votes to be won. In 2014, the World Bank ranked India as home to the world’s largest unelectrified population. Power was either unaffordable, inadequate or non-existent for 240 million people, according to data from the International Energy Agency. An expanding economy and population put the country on track to be the biggest driver of global energy demand through 2040, according to the Paris-based International Energy Agency.

But progress has been patchy. The government has met 77% of its target to link villages to power grids, yet only about 14% for villages earmarked for off-grid power like solar. Some 47 million rural households are still without electricity, and even those connected to the grid suffer frequent outages.

Federal renewable energy secretary Rajeev Kapoor didn’t immediately respond to calls and a text message seeking comments.

In 2012, the nation suffered one of the worst blackouts in history when the national grid collapsed, cutting power for two days to almost half the nation’s population. About one in five Indians lacked access to electricity, compared with full electrification in China, the International Energy Agency said in a 2016 report.

When the first solar units were installed in Bhamana in 2010, most houses got a small photovoltaic panel connected to a battery that could power a light for five to six hours. Seven years later, only four or five houses still have working lamps.

Dead battery

“We have no clue how to fix the equipment,” said Achildar Pesra Pawra, a member of the Bhamana village council. “Some batteries stopped working within months. Others lasted for about two years. Some of the solar panels were broken.”

Part of the problem is that the factors that make solar attractive for isolated communities—ease of transport and installation—also make them easy to steal, said Shantanu Jaiswal, an analyst at Bloomberg New Energy Finance.

India plans to expand renewable generation capacity more than three-fold to 175 gigawatts by 2022, with the majority from solar. Almost a quarter of the total will be supplied by rooftop panels.

“The instances of theft and destruction of distributed renewable energy appliances has been very prevalent in programs especially run by aid agencies as part of corporate social responsibility or where the government provides a subsidy,” said Jarnail Singh, India director at The Climate Group, a London-based organization promoting low-carbon solutions. “This is because there is no maintenance of equipment after installation.”

Maoist guerrillas

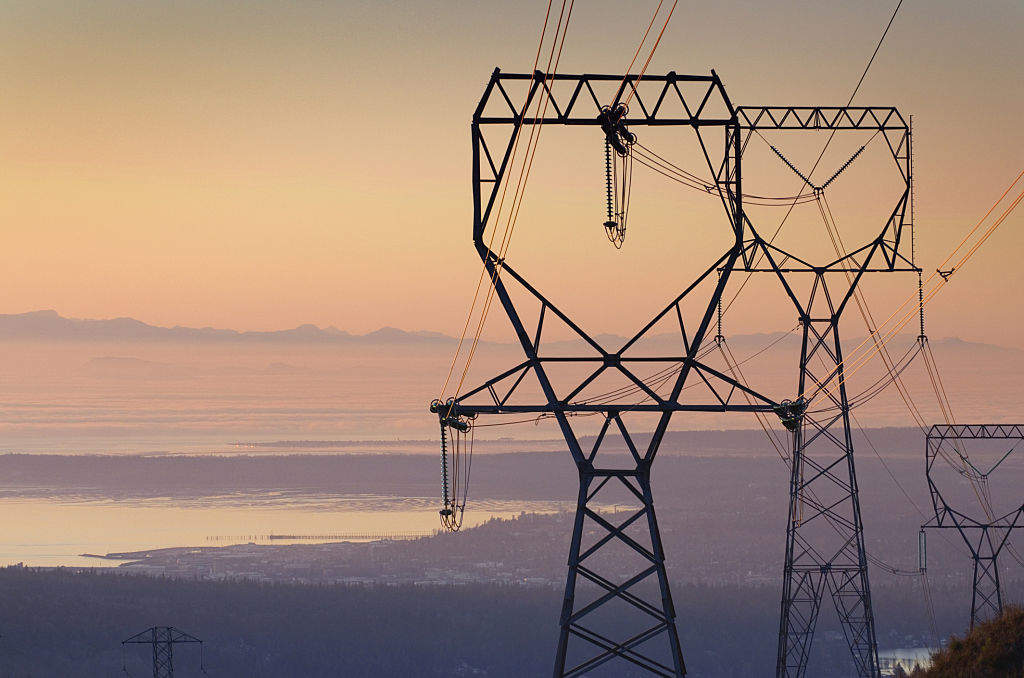

As a result, Maharashtra’s state-owned power retailer is now planning to spend Rs3.85 billion by 2018 to connect many of the isolated villages to the grid.

That won’t be easy. Most of the 288 villages that no longer qualify to be called electrified are in mountainous and thickly forested areas. That means getting approval from the forest department to run transmission lines across the land. And in some cases it means finding contractors willing to venture into areas populated with Maoist insurgents.

“We are not able to enter some of these areas,” Saboo said. “Many contractors are not prepared to work there and those that are charge very high rates. We are already allowing the highest rates in these areas so that they can get electrified.”

For villagers like Thingya, one of the greatest losses from the failure of the solar project is at the village primary school, which was able to light its cavernous classroom even in the dark monsoon days. Now his six children learn in the open air in the dry months and don’t have light to read or study at home.

My View:

The issues related to solar power will exist if the proper maintenance is not carried out. Theft of panels,damage to panels etc. will be there if proper maintenance is not available. Government should concentrate on maintenance part so that the supply from solar panel becomes more reliable.